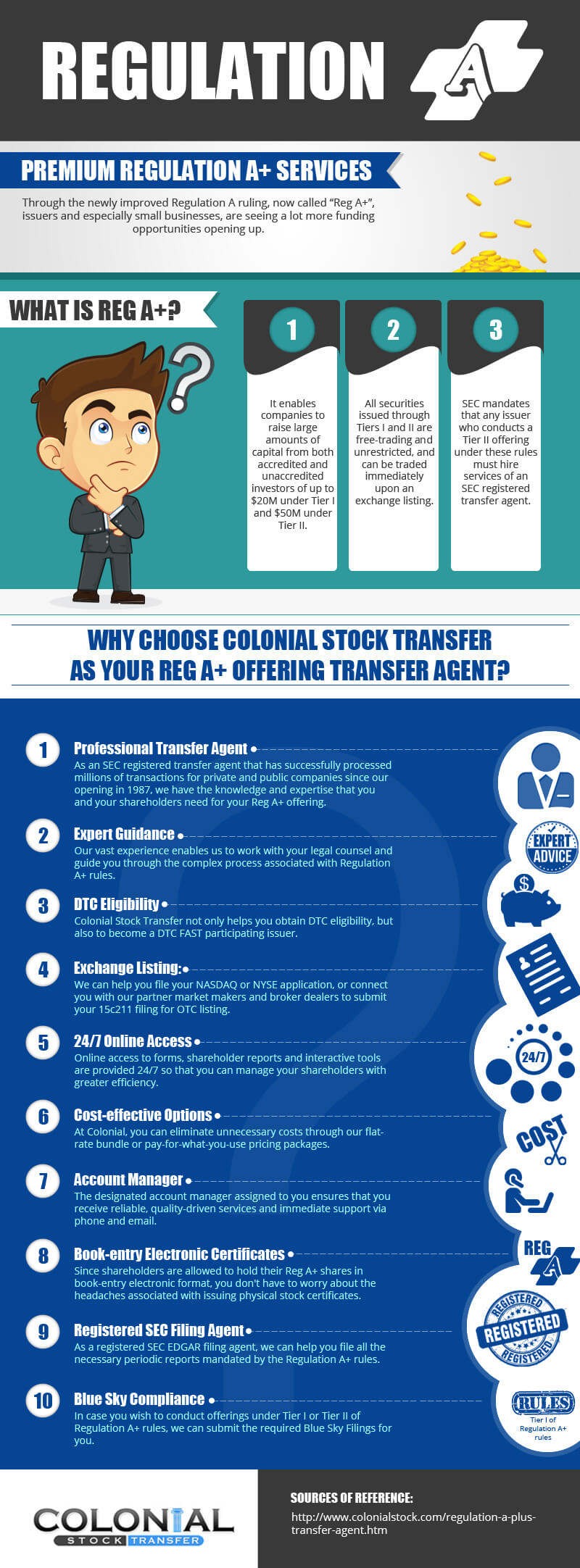

Regulation A+ Transfer Agent Services

Regulation A (Reg A+) allows companies to raise capital from both accredited and unaccredited investors with free-trading shares. Our Reg A+ transfer agent services help companies better manage shareholders from these and earlier offerings. New funding limits of $20M for Tier I and $75M for Tier II allow companies to offer and sell more unrestricted and freely transferable securities, allowing for immediate secondary trading. Smaller companies gaining more means to capital is beneficial for small business growth. Reg A+ is a crucial step forward in allowing smaller companies access to more capital by raising the funding limits.

The SEC mandates that any issuers conducting a Tier II offering under the Reg A+ rules must engage the services of a stock transfer agent. The transfer agent must be registered with the SEC as outlined in Section 17A of the Exchange Act.

Here are some of the benefits of using Colonial as your SEC registered transfer agent Reg A+ offering:

- Professional Transfer Agency: We've been in business for over 30 years as a professional transfer agent, registered in good standing with the SEC since our opening. Our focus is on providing quality service, expertise, and innovative technology to help your company manage your investors better. We provide your shareholders with peace of mind, knowing that an independent transfer agent is managing their stock.

- Offering Guidance: We can work with your legal counsel to guide you through the complex process associated with Regulation A+ security laws and logistics.

- Escrow Services: We provide a full suite of escrow agent services for Reg A+ offerings including offering closing support, payment distribution, and bank account maintenance and reconciliation.

- DTC Eligibility: We can help you obtain DTC eligibility, and become a FAST/DWAC participating issuer.

- Exchange Listing: We can help you file your stock exchange application to the NASDAQ or NYSE, or connect you with a market maker to submit your 15c211 filing for OTC listing.

- 24/7 Online Access: We provide 24/7 online access to forms, shareholder reports, and interactive tools to help better manage shareholders.

- Cost Savings: Eliminate unnecessary fees and instead utilize our a-la-carte option which allows you to only pay for the services you need.

- Account Manager: We guarantee reliable and quality driven service, and always provide quick responses through phone and email. We also provide you with a designated account manager.

- Book-entry Electronic Certificates: Our services eliminate physical stock certificates, and instead allow shareholders to hold their Reg A+ shares in book-entry electronic form for direct DWAC to the broker.

- Registered SEC Filing Agent: As an SEC EDGAR filing agent, we can help you file the necessary periodic reports mandated by Reg A+:

- Form DOS: Non-public draft Reg A Offering Statement

- Form 1-A: Reg A Offering Statement

- Form 1-A POS: Post-qualification amendment

- Form 1-A-W: Withdrawal of offering statement

- Form 1-K: Annual Report

- Form 1-SA: Semiannual Report

- Form 1-U: Current Report

- Form 1-Z: Exit Report

- Form 1-Z/W: Withdrawal of Exit Report

- Blue Sky Compliance: One of the biggest debates over the new rules of Regulation A+ was over whether these new regulations were subject to state Blue Sky Laws. Eventually a compromise was reached, and adherence to Blue Sky Laws is required under Tier 1 of Regulation A+. However, offerings made under Tier 2 of Regulation A+ don't require adherence to Blue Sky Laws. If you're conducting offerings under Tier 1, we can ensure Blue Sky compliance.

If you're thinking about using Regulation A+ to raise capital, look no further than Colonial Stock Transfer.

For more information on the ruling, please see our blog posting: SEC Issues Final Rules on Regulation A+

Request Proposal

Contact a sales representative to learn more about our transfer agent services at 877-285-8605.